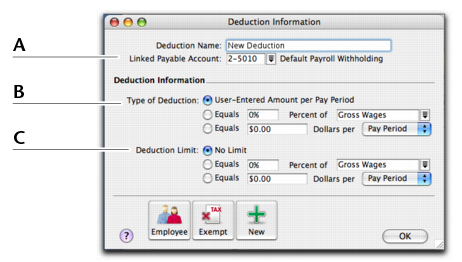

Paying your employees > Creating payroll categories > Deduction Information window

|

Linked Payable Account is the account (usually a liability account) in which all the deducted money will be accrued. The Default Withholding Payable Account you specified when setting up payroll appears as the default. You should change this default if you want to track the deduction separately. For example, if you are deducting union fees, create a Union Fees Payable liability account. This way, the balance sheet will display the deductions separately from your taxes and other deductions.

|

|||||||

|

Type of Deduction may be one of the following choices:

Type or select a wage category upon which the calculation is to be based. Alternatively, you can select Gross Wages or Federal Wages, which totals all wage categories (hourly and salary) you pay an employee.

|

|||||||

|

Deduction Limit may be one of the following choices:

|

|||||||