Lists > Setting up tax codes

Tax codes are used to track tax paid to and by your business. Each tax code represents a particular type of tax, which is used to calculate tax on your transactions.

Your software has an extensive list of tax codes that can be used in a variety of situations—for example, when doing business with overseas customers, when tracking capital acquisitions and so on.

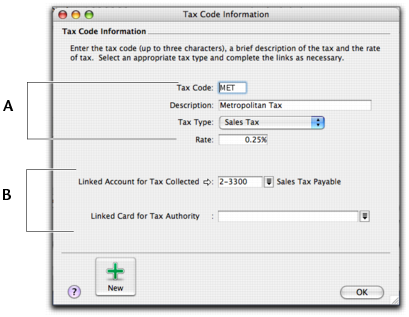

You can create consolidated tax codes by combining two or more tax codes. For example, the CST tax code (with an 8.25% tax rate) is composed of CTY (City Sales Tax) at 4%, STE (State Sales Tax) at 4%, and MET (Metropolitan Tax) at 0.25%.

note : You can only consolidate tax codes that are in your tax code list

Make sure you first create the tax codes you want to consolidate. The rest of the fields are filled in for you and the consolidated tax rate is calculated automatically.