End-of-period procedures > Month-end procedures > Task 5: Record depreciation

Task 5: Record depreciation

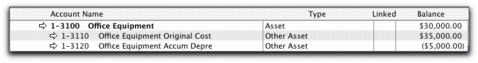

Your company’s vehicles and equipment lose value each year. Part of the cost of vehicles and equipment can be allocated as an expense to your company each year that you benefit from their use. The allocation of the cost of a piece of equipment over its useful life is called depreciation.

There are several methods of recording depreciation. Consult your accountant to see which method is best for you.

If you depreciate your assets at the end of the fiscal year, make this step a part of your end-of-year routine. Consult your tax adviser or accountant for information on when to depreciate your assets.

Your AccountEdge software doesn’t calculate depreciation automatically, but you can record your depreciation figures with a journal entry.