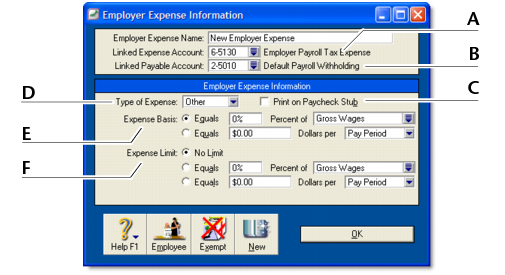

Paying your employees > Creating payroll categories > Employer Expense Information window

|

Linked Expense Account is the account to which you are charging this expense. The Account for Employer Expenses you specified when setting up payroll appears as the default.

|

|||||||

|

Linked Payable Account is the liability account to which your expense will accrue. The Account for Deductions & Expenses you specified when setting up payroll appears as the default.

|

|||||||

|

If you want amounts you have paid to appear on employees’ check stubs or pay advices, select the Print on Paycheque Stub option.

|

|||||||

|

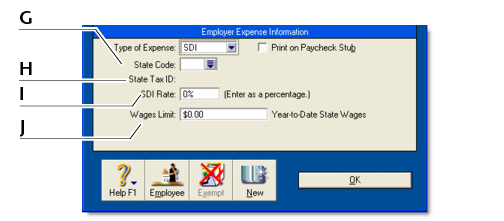

Click the Type of Expense arrow and choose the expense type:

|

|||||||

|

|||||||

|

If you are creating an Other expense type, limits can be used to place a ceiling on the expense. For example, for an expense of $30 per pay period and a limit of 2% of Gross Wages, a paycheque with Gross Wages of $1,000 yields an expense of only $20 (i.e. 2%). Limit may be one of the following:

|

|||||||

|

If you are creating an Accrual expense type, Expense Basis can be:

|

|||||||

|

If you are creating an Accrual expense type, it is necessary to link the Accrual to the corresponding Wage category. This will ensure that the system will decrease the employees Accrual Balance when the Vacation or Sick time is used.

|

|||||||