|

■

|

You can enter a quote to store an estimate or quote you received from one of your suppliers. A quote has no impact on your inventory levels and can be changed to an order or a bill when you are ready to purchase.

|

|

■

|

An order is a purchase where no service or item has been received. While orders do not affect your financial figures, they are included in your inventory reports. Orders don’t create transactions unless you have paid a deposit to the supplier. An order can be changed to a bill but not to a quote.

|

|

■

|

You can use a receive item purchase to record the receipt of items you have ordered but have not yet billed for. When you record items received, the item is added to your inventory and the cost of the item is added to an accrual account for inventory items until you record a bill for it.

|

An account payable transaction is not recorded at this time. You can only record a received transactions in the item layout, and only against an order.

|

■

|

A bill is usually created when you receive the items or services you ordered and are required to pay the supplier (that is, you have been charged for the purchase). Recording a bill will update the appropriate accounts, including the account for tracking payables. Bills can be open (unpaid), closed (paid), or debit (negative purchase). A bill cannot be changed to a quote or an order.

|

|

■

|

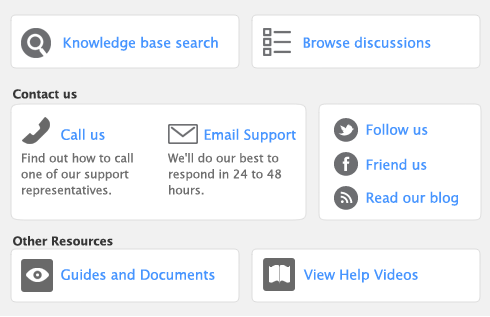

the Purchases window

|

|

■

|

the Bank Register window.

|

The purchases procedure described in this section is for entering purchases in the Purchases window, which allows you to record full details about a transaction.

Entering a purchase in the Bank Register window is a fast way to enter a purchase transaction. However, you can enter less detail about the purchase than if you entered it in the Purchases window. For more information, see ‘Entering transactions in the Bank Register window’.

You can also create a purchase order in the Sales window when you enter a sales quote or sales order. For more information, see ‘Creating a purchase order from a sale’.