|

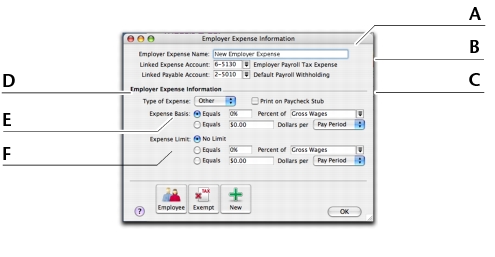

Linked Expense Account is the account to which you are charging this expense. The Account for Employer Expenses you specified when setting up payroll appears as the default.

|

|||||||

|

Linked Payable Account is the liability account to which your expense will accrue. The Account for Deductions & Expenses you specified when setting up payroll appears as the default.

|

|||||||

|

If you want amounts you have paid to appear on employees’ check stubs or pay advices, select the Print on Paycheck Stub option.

|

|||||||

|

Click the Type of Expense arrow and choose the expense type:

|

|||||||

|

|||||||

|

If you are creating an Other expense type, limits can be used to place a ceiling on the expense. For example, for an expense of $30 per pay period and a limit of 2% of Gross Wages, a paycheck with Gross Wages of $1,000 yields an expense of only $20 (i.e. 2%). Limit may be one of the following:

|

|||||||

|

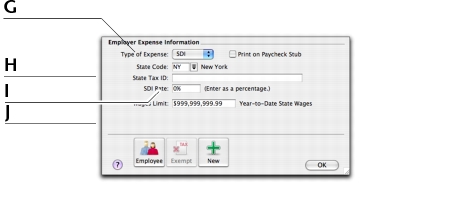

If you are creating an SUI or SDI expense, type or select a state postal abbreviation for the employer expense.

|

|||||||

|

If you are creating an SUI or SDI expense type, enter your company's state tax identification number in the State Tax ID field.

|

|||||||

|

If you are creating an SUI expense type, enter your company's state unemployment insurance (SUI) rate as a percentage.

If you are creating an SDI expense type, enter your company's state disability insurance (SDI) rate as a percentage.

|

|||||||