Creating payroll categories

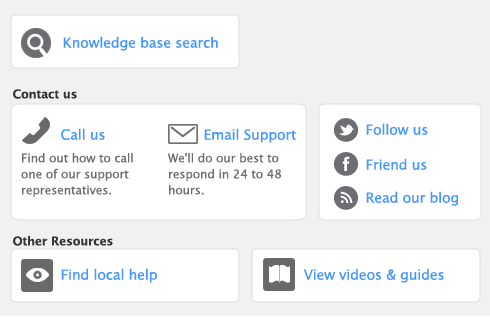

An employee’s pay is made up of separate components, such as normal time, overtime, union deductions, taxes, and so on. In your software, these components are called payroll categories, and they are grouped into five types: wages, accruals, deductions, employer expenses, and taxes.

|

All monies paid to an employee for labor or services rendered on an hourly, salary, or other basis.

|

|

|

Items such as vacation and sick leave, which employees accrue under the terms of their work agreement.

|

|

|

Monies withheld by the employer and paid to other organizations on behalf of the employee, for example, union fees.

|

|

|

Employer expenses

|

Employer-paid benefits, for example, medical insurance.

|

|

Amounts withheld by the employer from the employee’s paycheck and paid to a federal, state, or local government.

|

A default list of payroll categories is generated when you create your company file. You may want to review these categories and tailor them to suit your business needs.