This type of tax code doesn't add tax to the transaction but tracks the accrued tax that you would owe for Use Tax. The sale tax reports will now include a section to break out purchases that you may owe Use Tax for.

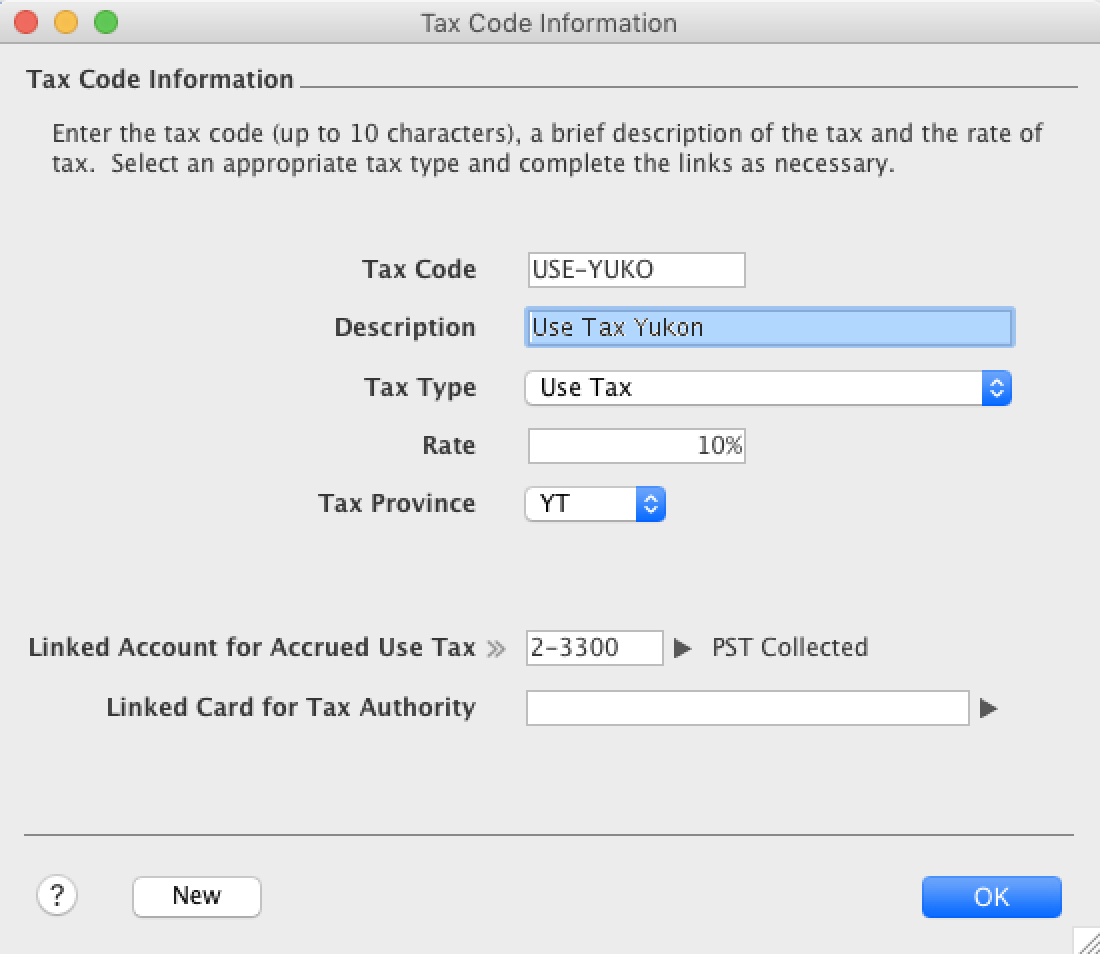

When creating a tax code, you'll see a new tax type to selected for Use Tax. Enter the tax rate and choose a linked accrued liability account to track the Use Tax that will be owed to the province.

An additional field for Tax Province can be selected which is used on Sales Tax by Province reports.

When paying your Sales & Use Tax to the appropriate province tax authority, you would create a Spend Money transaction applied against the linked accounted used for Accrued Use Tax.