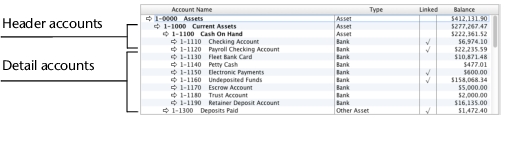

If your accountant or partner has provided you with a company file, this task may have been completed for you. In this case, go to ‘Enter account opening balances’.

|

▪

|