Accounts provide a means for grouping similar transactions. For example, if your business pays rent for the use of its premises, you would create a rent account and then allocate all rent payments to that account.

If your accountant or partner has provided you with a company file, this task may have been completed for you. In this case, go to

Enter account opening balances.

When you created your company file, you selected a default accounts list to start with. This list may already have the accounts you need. If not, you can change the list to suit your needs. If you are unsure, ask your accountant which accounts you should create, edit, or delete.

Each account is identified by a unique five digit number. The first digit indicates the account’s classification (for example, accounts starting with 1 are asset accounts). The remaining four digits determine its location within the classification. The lower the number, the higher up in the list it appears. For example, account 1-1100 appears above 1-1200.

The accounts list groups accounts into eight classifications—Assets, Liabilities, Equity, Income, Cost of Sales, Expenses, Other Income, and Other Expenses. Within each account classification there is at least one account type.

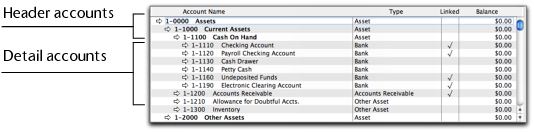

Your accounts list consists of detail accounts (the accounts to which you allocate transactions) and header accounts. Header accounts group related detail accounts to help you organize your accounts list.

For example, you could group your telephone, electricity, and gas expense accounts using a Utilities header account. This makes it easier for you to locate the utility expense accounts in the accounts list and to see your combined utility expenses.