|

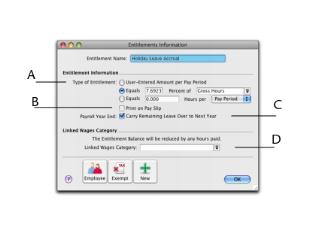

Type of Entitlement can be:

Type the percentage in the first field and then select the wage category from the selection list, which shows all your hourly wage categories, in addition to Gross Wage. This totals all wage categories (hourly and salary) you pay an employee.

|

|||||

For example, for 2 fortnightly pay periods on one paycheque, you would double it to 12.308 hours.

|

|||||

|

If you want the entitlement amount to appear on the paycheque, select the Print on Pay Slip option.

|

|||||

|

If you want to carry over any entitlement leave balance from the previous year, select the Carry Remaining Leave Over to Next Year option.

|

|||||

|

Each entitlement category must have a Linked Wages Category. For example, the Holiday Leave Entitlement could be linked to the Holiday Pay wage category and the Sick Leave Entitlement could be linked to the Sick Pay wage category. If you create a new entitlement, you must link it to a wage category.

When employees use their entitlement, for example, by taking a holiday, you allocate the hours taken against the linked wage category (in this example, the holiday pay wage category). The employee’s accrued leave balance is reduced by the hours taken.

Note that you can link multiple wage categories to an accrual. This enables you to provide and track different types of the same accrual. For example, you can link a Sick Pay With Certificate wage category and Sick Pay Without Certificate wage category to sick leave accrual. When an employee takes either type of leave, your sick leave accrual is reduced by the hours taken.

|

|||||