|

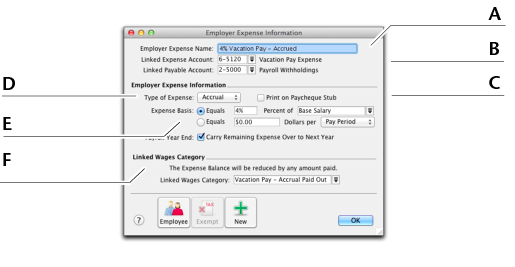

Linked Expense Account is the account to which you are charging this expense. The Account for Employer Expenses you specified when setting up payroll appears as the default.

|

|||||

|

Linked Payable Account is the liability account to which your expense will accrue. The Account for Deductions & Expenses you specified when setting up payroll appears as the default.

|

|||||

|

If you want amounts you have paid to appear on employees’ cheque stubs or pay advices, select the Print on Paycheque Stub option.

|

|||||

|

Click the Type of Expense arrow and choose the expense type:

|

|||||

|

|||||

|

|||||