Accounts provide a means for grouping similar transactions. For example, if your business pays rent for the use of its premises, you would create a rent account and then allocate all rent payments to that account.

The accounts you use for your business are grouped in an accounts list.

If your accountant or partner has provided you with a company file, this task may have been completed for you. In this case, go to ‘Enter account opening balances’.

When you created your company file, you selected a default accounts list to start with. This list may already have the accounts you need. If not, you can change the list to suit your needs. If you are unsure, ask your accountant which accounts you should create, edit, or delete.

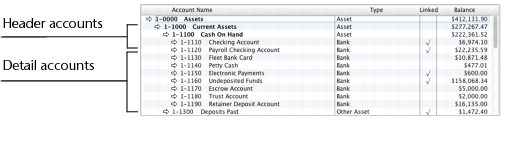

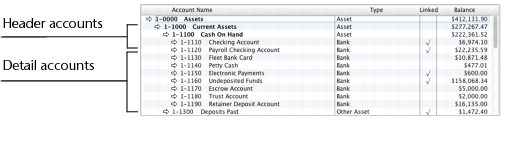

Each account is identified by a unique five digit number. The first digit indicates the account’s classification (for example, accounts starting with 1 are asset accounts). The remaining four digits determine its location within the classification. The lower the number, the higher up in the list it appears. For example, account 1-1100 appears above 1-1200.

The accounts list groups accounts into eight classifications—Assets, Liabilities, Equity, Income, Cost of Sales, Expenses, Other Income, and Other Expenses. Within each account classification there is at least one account type.

|

Asset

(1-xxxx) |

Money in the bank, for example, in a checking or savings account.

|

|

|

Accounts Receivable

|

Money owed to you by your customers.

|

|

|

Other Current Asset

|

Assets that, if required, can be turned into cash within a year. These may include your term deposits.

|

|

|

Assets which have a long life, for example, buildings, cars, and computers. Fixed assets are usually depreciated.

|

||

|

Other assets you own such as loans made to others and goodwill.

|

||

|

Liability

(2-xxxx) |

Repayments required to service credit card debt.

|

|

|

Accounts Payable

|

Money owed by you to your vendors.

|

|

|

Other Current Liability

|

Money owed by you that is due in less than a year, for example, STE.

|

|

|

Long Term Liability

|

Money owed by you that is due in more than one year, for example, a business loan.

|

|

|

Equity

(3-xxxx) |

The business’s net worth, that is, its assets minus its liabilities. Common equity accounts are current year earnings, retained earnings, and shareholders’ equity.

|

|

|

Income

(4-xxxx) |

Revenue from the sale of goods and services.

|

|

|

Cost of Sales

(5-xxxx) |

The direct cost of selling your goods and providing services, for example, purchase costs and freight charges.

|

|

|

Expense

(6-xxxx) |

The day-to-day expenses of running your business, for example, utility bills, employee wages, and cleaning.

|

|

|

Other Income

(8-xxxx) |

Other revenues, for example, interest earned on savings and dividends paid from stocks.

|

|

|

Other Expense

(9-xxxx) |

Other Expense

|

Other expenses, for example, interest charged.

|

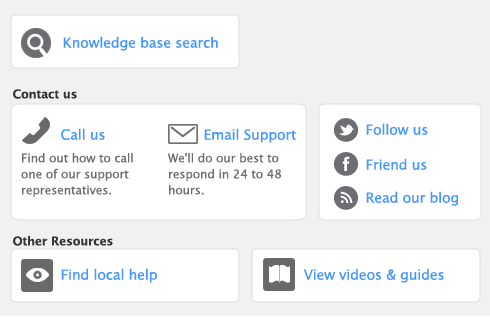

Your accounts list consists of detail accounts (the accounts to which you allocate transactions) and header accounts. Header accounts group related detail accounts to help you organize your accounts list.

For example, you could group your telephone, electricity, and gas expense accounts using a Utilities header account. This makes it easier for you to locate the utility expense accounts in the accounts list and to see your combined utility expenses.

You group accounts by indenting the detail accounts located directly below a header account.

|

▪

|

The balance of a header account is the sum of the detail accounts indented directly below it.

|

|

▪

|

You can create up to three header account levels as shown in the example above.

|

|

1

|

|

2

|

|

3

|

|

4

|

Select the account type from the Account Type list. The Account Classification field changes according to the selection you make. For more information on account classifications, see ‘Account classifications and types’.

|

|

5

|

Enter a four-digit number for the account in the Account Number field. The number must be unique within each account classification.

|

|

6

|

Press Tab and type a name for the account.

|

|

7

|

Click the Details tab.

|

|

8

|

If you want, type a brief description of the account in the Description field.

|

|

9

|

In the Tax Code field, select the tax code that you use most often with transactions that will be posted to this account.

|

|

10

|

If you are creating an asset, liability, or equity account (other than an asset that has the account type of Bank), select an option from the Classification for Statement of Cash Flows list.

|

Classifying the accounts allows you to generate a statement of cash flows. This report shows how your cash position has changed over time, profit earned, and where your cash was spent. If you’re unsure about which classification to use, consult your accountant or a Certified Consultant.

|

11

|

If you are creating a bank or credit card account, and you want to keep a record of your bank account details, click the Banking tab and enter your account details.

|

The ABA routing number and account details are required so that Direct Deposit and Vendor Payments can include information about the account when making electronic payments.

|

12

|

[Detail accounts only] If you want to enter historical balances, complete the Last FY column on the History tab. That way you can compare the year’s monthly account balances with those of the corresponding months last year.

|

|

a

|

|

c

|

Click Close.

|

|

14

|

Click OK when you have finished. The account you created now appears in your accounts list.

|

You group accounts by indenting the accounts located below a header account.

|

1

|

|

3

|

Click Down to group the account with the header located above it.

|

|

▪

|